venmo tax reporting limit

For the 2021 tax year Venmo will issue your tax documents electronically. The American Rescue Plan Act lowered the threshold for reporting P2P network transactions to.

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

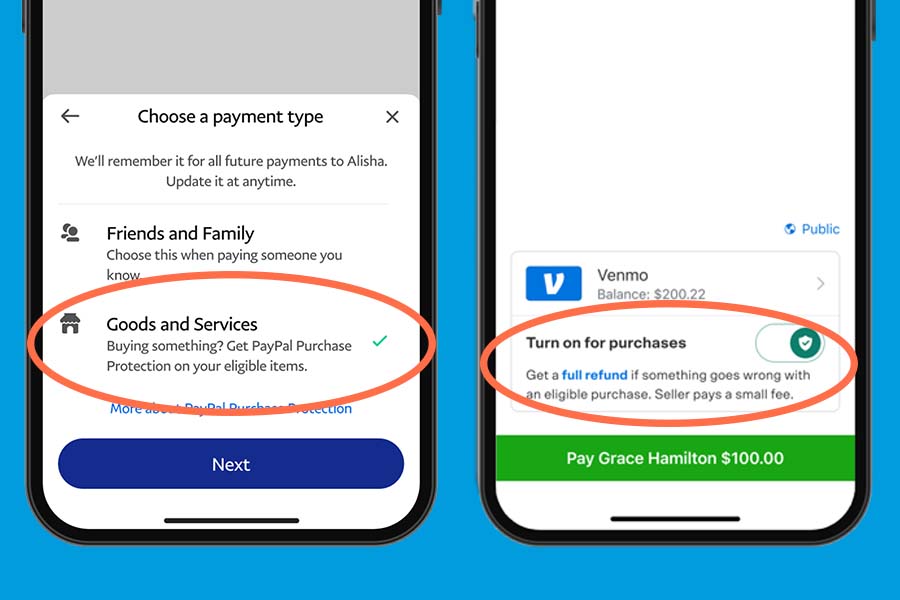

Starting this year all third-party payment processors in the United States are required to report payments received for goods and services of more than 600 a year.

. The IRS views the payment andor receipt of money through Venmo or any similar peer-to-peer P2P app the same as a traditional payment andor receipt of cash. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. Venmo has some limits on how much you can send in a given week.

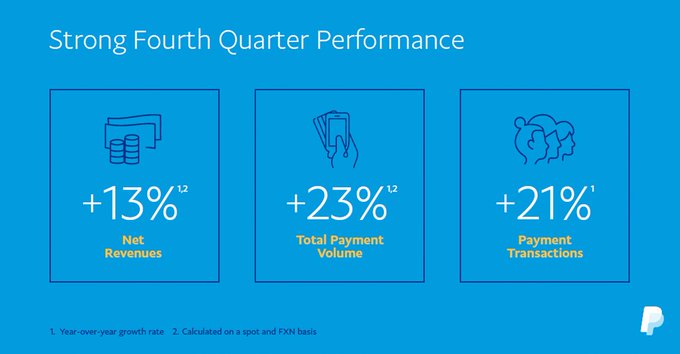

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. Congress updated the rules in the American Rescue Plan Act of 2021. If the funds being transferred are for goods or a service the new law simply requires businesses to report those funds exceeding 600 rather than the old 20000 limit.

But users were largely mistaken to believe the change applied to them. As previously mentioned a copy of this. If you have not yet completed identity verification you will have a weekly.

There isnt a specific daily. Payments of 600 or. The American Rescue Plan Act of 2021 significantly reduced the reporting threshold associated with Form 1099-K for card payment processors and third-party payment networks.

For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence. If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year.

If you havent verified your Venmo account your weekly spendsend limit is 29999. But Venmo tax reporting laws have changed and this change applies to all other P2P apps too. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal.

This new tax rule only applies to payments for goods and services not for personal payments between friends and family. Previously the threshold was 20000 in income and. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the.

For most states the threshold is. The new tax reporting requirement will impact your 2022 tax return filed in 2023 Payments of 600 or more for goods and services through a third-party payment network such. Read on for more information about these limits.

The change in tax law put into effect by the American Rescue Plan during the Covid requires your gross income to be. The reporting thresholds have been revised for the year 2022. Sites like Venmo and PayPal now must report business transactions to the IRS when they total 600year.

Shortly after the new year begins theyll be available for download after you sign into your account from the web at.

Clarifications And Complexities Of The New 1099 K Reporting Requirements

Fact Or Fiction You Ll Owe Taxes On Money Earned Through Paypal Cash App And Venmo This Year Cnet

Nowthis If You Are Doing Business With Your Clients Using Third Party Apps Like Cash App Paypal Venmo Or Zelle You Should Know That The Irs Will Soon Require Businesses To Report

Tax Changes Coming For Cash App Transactions

Venmo Paypal Commercial Transactions Get New 600 Year Reporting Rule

Venmo Vs Paypal Which To Use And When Forbes Advisor

Press Release New U S Tax Reporting Requirements Your Questions Answered

Venmo Cashapp And Other Payment Apps Face New Tax Reporting Rule Cnn Business

Businesses Should Prepare For The Lower 1099 K Filing Threshold Dalby Wendland Co P C

New Law Impacting Peer To Peer Payment App Users

Irs Cracking Down On Businesses Which Use Cash Apps Transactions Localmemphis Com

Will The Irs Track Every Venmo Transaction Fact Checking Financial Reporting Plans

Venmo And Paypal Will Now Share Your Transactions With The Irs If You Make More Than 600 A Year On The Platforms The Washington Post

Paypal Taxes 2022 How Big Are The Transactions This App And Venmo Report To The Irs Marca

Are Biden And Dems Planning To Spy On Bank And Cash App Accounts Snopes Com

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

Getting Paid On Venmo Or Cash App There S A Tax For That Los Angeles Times

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc