how much is inheritance tax in wv

Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. Six states currently have an inheritance tax while 14 impose an estate tax.

Baron Law Llc An Ab Trust What Are The Benefits For Your Estate Trust Estate Planning Attorney Estate Planning

Do I have to pay taxes on a 10 000 inheritance.

. However state residents must remember to take into account the federal. The federal estate tax works much like the income tax. Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and PennsylvaniaNotice that Maryland and New Jersey collect both state estate taxes and inheritance taxes.

56 million West Virginia. Heres how estate and inheritance taxes would work. Two states Maryland and New Jersey have both taxes.

Everyone is pleased to learn that West Virginia has adopted the Federal guidelines with regard to inheritance and estate tax. Spouses are exempt meaning they dont pay taxes on any money they inherit Decedents are also exempt which includes children and grandchildren who also wont pay taxes on money they inherit. Odd Squad Family is an independent hip hop group from Phoenix Arizona.

The Economic Growth and Tax Relief Reconciliation Act of 2001 has also eliminated the estate tax in West Virginia. The top estate tax rate is 20 percent exemption threshold. The top estate tax rate is 16 percent exemption threshold.

Like most states there is no West Virginia inheritance tax. However there are certain cases when West Virginia residents may find themselves responsible for federal taxation that can reach as much as 40 of the inherited estate. This exclusion lets you avoid paying taxes on the gains from a home sale up to 250000 or 500000 if two people file jointly.

Monday February 24th 2020 708 pm. There can be two kinds of death taxes inheritance taxes and estate taxes. Property owned jointly between spouses is exempt from inheritance tax.

That means if you inherit property either real property personal property or intangible property like financial accounts or cash you will not have to pay an inheritance tax in WV West Virginia inheritance tax on the value of the inherited property. You would receive 950000. 77 Fairfax Street Room 102.

And in. A family history study 311 yielded a morbid risk estimate of 9. The home sale tax exclusion is one of the more generous tax exclusion rules.

Technically it can happen in two cases. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. 2193 million Washington DC District of Columbia.

If the estate is appraised for up to 1 million more than that threshold the. No estate tax or inheritance tax. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

25 of the total payment to a nonresident individual or entity who sells or exchanges real property located in West Virginia or 2. There is no federal inheritance tax but there is a federal estate tax. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption.

Although West Virginia has neither an estate tax or nor an inheritance tax the federal. 65 of the estimated capital gain derived from the sale or exchange. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

It would tax an heirs cumulative lifetime inheritances in excess of 23 million at the heirs federal income tax rate plus 15 percentage points and exempt up to 5000 in gifts and 25000 in bequests annually. 13 rows West Virginia Inheritance and Gift Tax. Inheritence Estate Tax.

The estate would pay 50000 5 in estate taxes. There is no inheritance tax in West Virginia. It was designed to raise as much federal revenue each year as the federal estate tax under 2009 parameters.

West Virginia collects neither an estate tax nor an inheritance tax. The first 10000 over the 1118 million exclusion are taxed at 18 the next 10000 are taxed at 20 and so on until amounts in excess of 1 million over the 1118 million exclusion are taxed at 40. The amount to be withheld is either.

7 hours agoDeveloping genetically engineered mouse models to study tumor suppression. Estate taxes are paid by the estate of the deceased while inheritance taxes are paid by the heirs. Berkeley Springs WV 25411.

If the gross estate does not exceed the. Six states collect a state inheritance tax as of 2021 and one of themMarylandcollects an estate tax as well. No estate tax or inheritance tax.

If you earn over 25000 youll pay between 0 15 in inheritance tax but there are some exceptions. You would pay 95000 10 in inheritance taxes. If You Inherit a Home Do You Qualify for the 250000500000 Home Sale Tax Exclusion.

The whitaker family inbred west virginia The whitaker family inbred west virginia Mode of Inheritance. State Inheritance Taxes. No estate tax or inheritance tax.

This means that unless you had massive gains on your homes sale you probably wont have to pay taxes on the amount. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax.

Pittsburgh Skyline Pittsburgh Skyline Skyline City Skyline

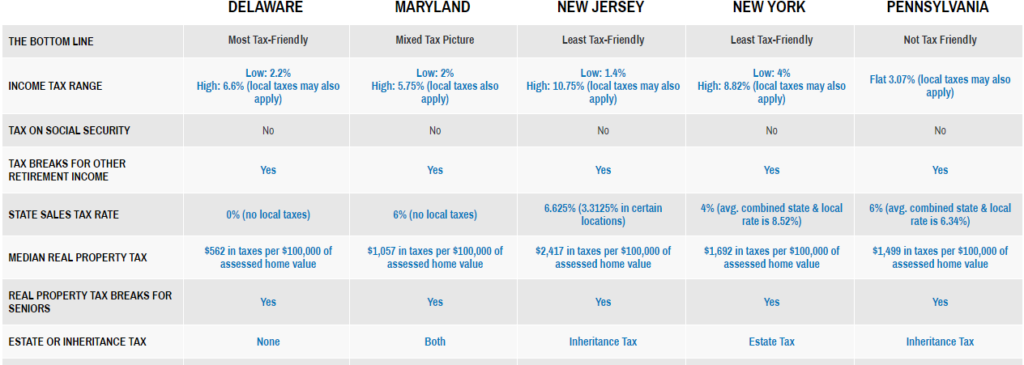

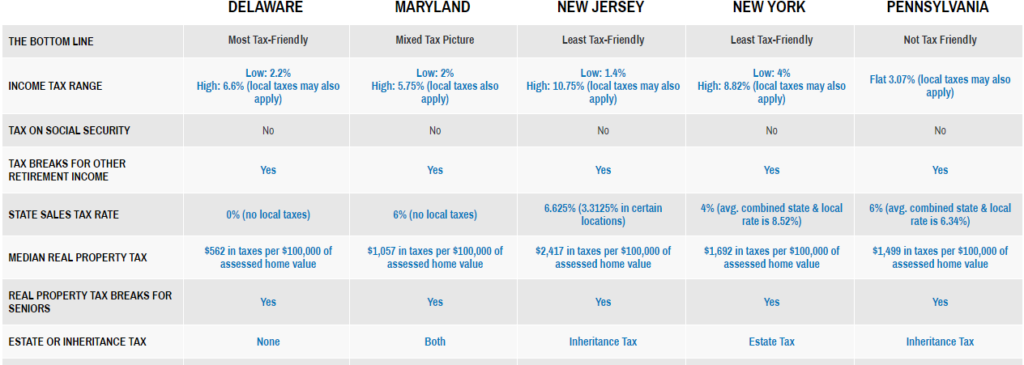

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

What Is A Bypass Trust In An Estate Plan

West Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There A Federal Inheritance Tax Legalzoom Com

West Virginia Estate Tax Everything You Need To Know Smartasset

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee

Wealthy May Face Up To 61 Tax Rate On Inherited Wealth Under Biden Plan

Kentucky Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

West Virginia Estate Tax Everything You Need To Know Smartasset

Understanding Capital Gains Tax When You Inherit Scott Partners

Estate Planning Inheritance Vs Estate Tax Protective Life

How To Avoid Paying Capital Gains Tax On Inherited Property Millionacres

Pittsburgh Light Up Night 2012 Pittsburgh City Pittsburgh Skyline Pittsburgh

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc